Help understanding Amazon Accounting

Hi all,

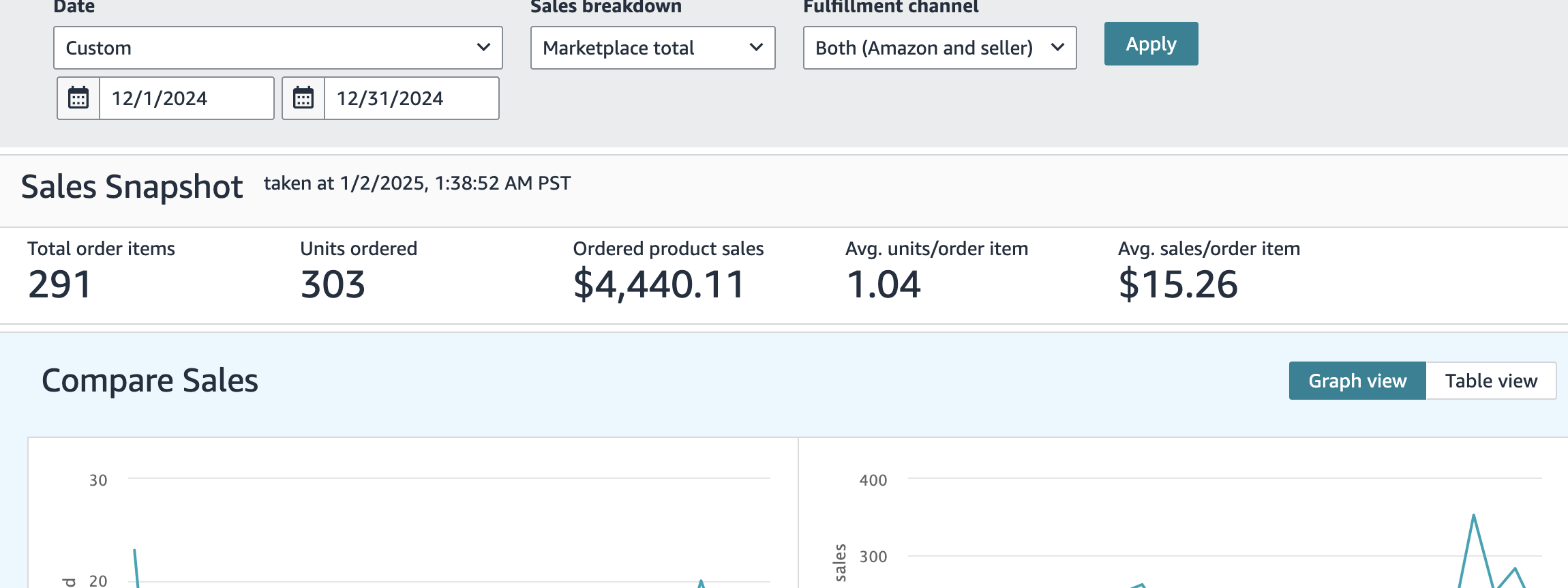

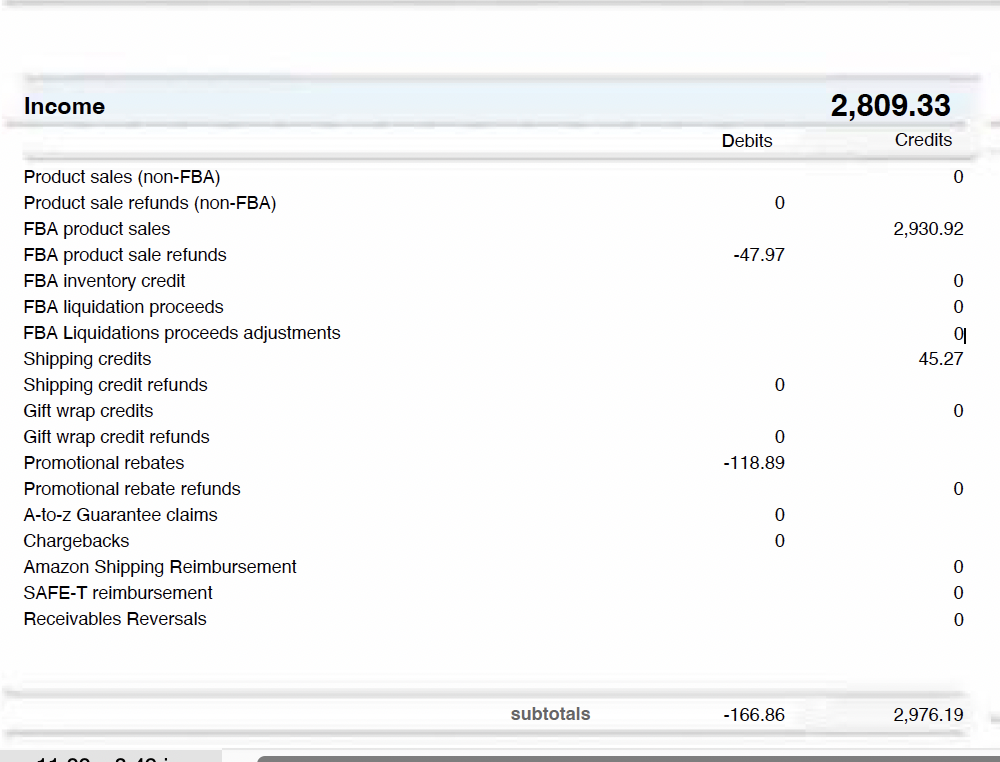

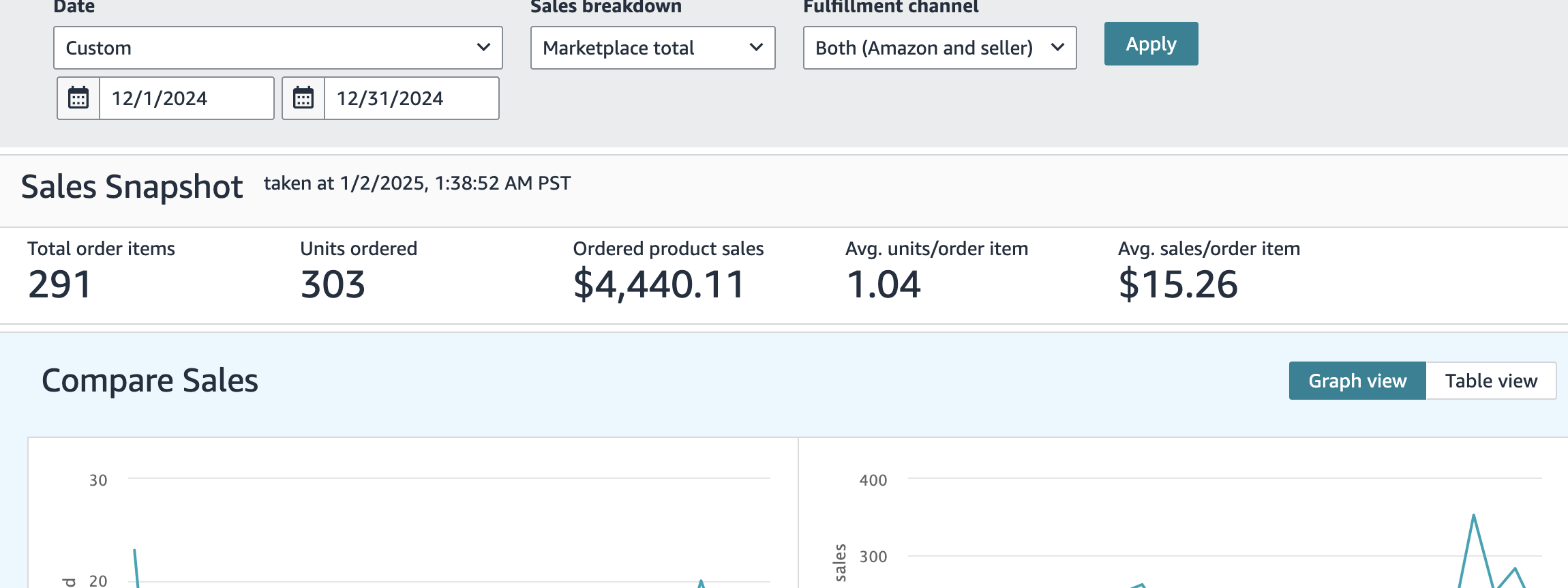

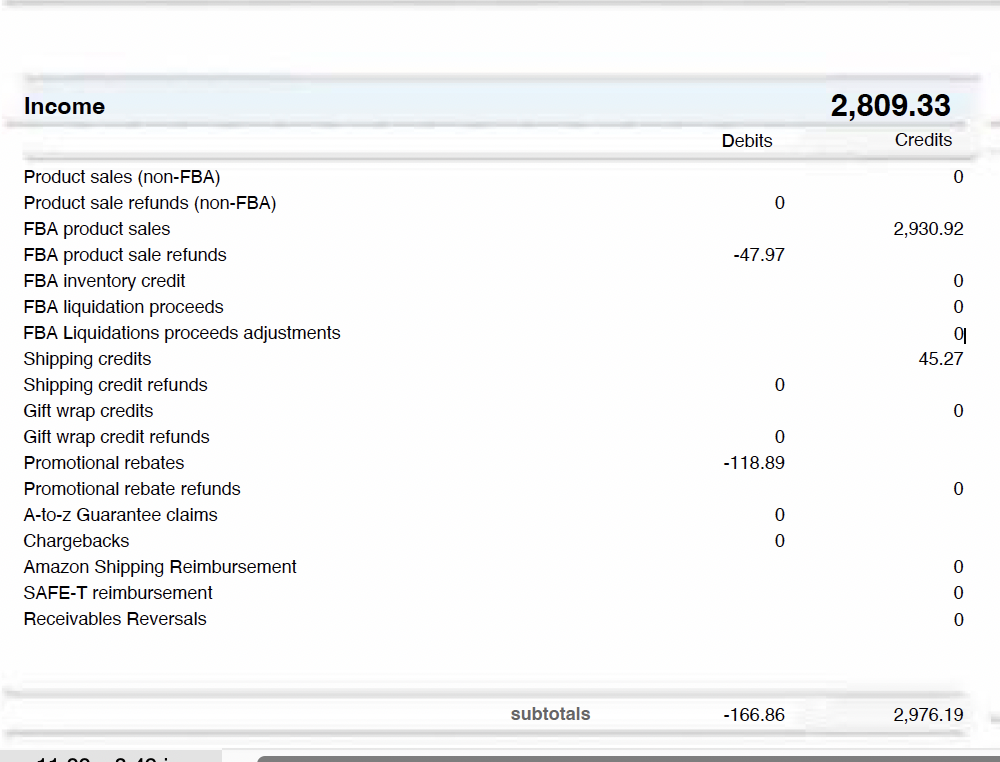

I'm a new-ish seller and I've having a really hard time understanding Amazon's accounting. For the month of December, I did around $4400 worth of sales. I just downloaded my sales repository report for December and it says total sales were $2800! I have $800 in 'deferred transactions' from sales over the past week but it still doesn't add up. What am I missing here? Seller support is of no help at all.

Help understanding Amazon Accounting

Hi all,

I'm a new-ish seller and I've having a really hard time understanding Amazon's accounting. For the month of December, I did around $4400 worth of sales. I just downloaded my sales repository report for December and it says total sales were $2800! I have $800 in 'deferred transactions' from sales over the past week but it still doesn't add up. What am I missing here? Seller support is of no help at all.

0 replies

Seller_i6S8knzW6zU6Z

Hi @Seller_wZN9FglHZ6rEU,

The difference between your $4,400 and $2,800 figures is actually quite normal. According to the help page (https://sellercentral.amazon.com/help/hub/reference/G200989470), Amazon's different reports are designed to show different aspects of your business, and the numbers will rarely match exactly. Here's why:

1. Order Status:

- Business Reports include cancelled orders, while Payments reports don't

- Business Reports show all orders placed, but Payments only shows orders that have actually shipped

2. Fees and Timing:

- Business Reports show pure sales numbers without Amazon fees

- Payments reports include Amazon fees

- You mentioned $800 in deferred transactions, which affects the Payments report

3. Refunds:

If you had any refunds, they're counted differently across reports:

- In Business Reports By Date, refunds count in the month they're processed

- In Customer Metrics, refunds count in the month of the original order

This explains why you're seeing different numbers across different reports - each serves a different purpose in tracking your business performance.

Best regards, Michael