LLC Type

I registered my LLC in USA and based upon that I registerd my Amazon seller account, now Amazon is asking me to choose the tax classification which I am not sure what should I choose,

First question is - What is you tax classification? and I chose the option "Business"

Second question is - Are you a U.S resident identity? and I chose the option "Yes" because my LLC is registered in US

Third one was the option "Federal tax classification" so I chose Limited Liability company ( LLC )

Now the fourth one is LLC type and the options are - S Corp, C corp and partnership, and I am not sure which option should I select (I am a single owner of this LLC )

It also mentions at the bottom that:

1. if you are an LLC that has filled a a form 8832 to be taxed as a corporation then you are a C corporation

2. And if if you are an LLC that has filled a a form 2553 to be taxed as a corporation then you are a S corporation

I have no idea which form was filled, I asked the person who formed my LLC, and she also has no idea,

If anyone help me figure out, if my LLC is S corporation or C corporation, I will be very grateful.

Thanks a lot in advance.

LLC Type

I registered my LLC in USA and based upon that I registerd my Amazon seller account, now Amazon is asking me to choose the tax classification which I am not sure what should I choose,

First question is - What is you tax classification? and I chose the option "Business"

Second question is - Are you a U.S resident identity? and I chose the option "Yes" because my LLC is registered in US

Third one was the option "Federal tax classification" so I chose Limited Liability company ( LLC )

Now the fourth one is LLC type and the options are - S Corp, C corp and partnership, and I am not sure which option should I select (I am a single owner of this LLC )

It also mentions at the bottom that:

1. if you are an LLC that has filled a a form 8832 to be taxed as a corporation then you are a C corporation

2. And if if you are an LLC that has filled a a form 2553 to be taxed as a corporation then you are a S corporation

I have no idea which form was filled, I asked the person who formed my LLC, and she also has no idea,

If anyone help me figure out, if my LLC is S corporation or C corporation, I will be very grateful.

Thanks a lot in advance.

0 replies

Seller_rI7BZIczK8iAC

I registered my LLC in USA

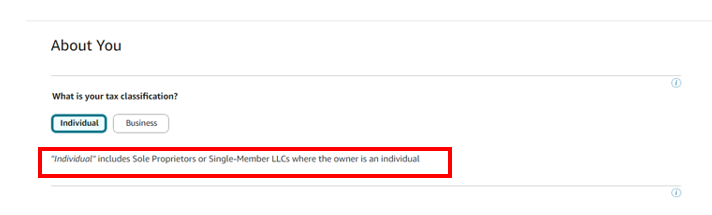

If you are a Single Member LLC you do NOT have to chose "Business" but "Individual". If cou can no longer change that, do NOT create the account but write them that you changed mind and actually don't want to sell on Amazon. After a month or so recreate a new seller account correctly with another email address.

CR_Amazon

@Seller_n0Jq3cMUbjz50

CR from Amazon here, thank you for the post. While I am unable to provide specific tax advice, I have provided several resources below with more information on Amazon tax guidelines.

State Tax Registration Numbers

After review, if your question is still unanswered, I recommend that you reach out to your tax professional for additional information.

CR_Amazon

Seller_rI7BZIczK8iAC

Yes, this sentence says exactly what I mentionned:

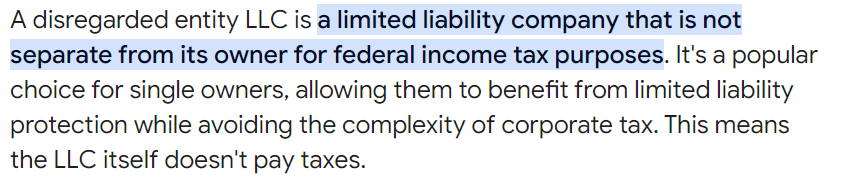

"Your tax classification can be "Individual" if you're either an Individual, or Sole Proprietor, or an LLC that is a disregarded entity owned by an individual."

Google says:

Following is from the "Tax Interview" you have to fill out when registering or verifying your accunt, probably you didn't look at it carefully enough: